2023 Property Taxes

Property Taxes are due and payable on the last business day of June 2023 which this year is Friday, June 30, 2023. This is to advise the ratepayers of Big Lakes County that the Property Assessment and Tax Notices were mailed out April 26, 2023.

A 7.5% penalty will be applied to current taxes and arrears if payment is received after June 30, 2023, and an additional 14.5% for payments made after the last business day in January 2024.

Failure to receive a tax notice doesn’t alleviate property from property taxation. If you don’t receive a property tax notice by May 31, 2023, please contact our office at 780-523-5955.

If your address has changed and you have not notified our office previously, please do so immediately by calling 780-523-5955, or faxing us at 780-523-4227 or e-mail [email protected] or send a letter to Big Lakes County, PO Box 239, High Prairie, AB T0G 1E0. Also please contact Land Titles to update your address; it will also update our system.

Payment remittance should be made payable to BIG LAKES COUNTY by accepted bank cheque, bank draft or money order, payable in Canadian funds. The postmark will determine date of payment. Property Taxes cannot be paid by credit card.

Payments can be made at the County Office, through online Banking through ATB, Royal Bank, TD Canada Trust, Horizon Credit Union, Scotia Bank or at the Royal Bank branch in High Prairie. Please provide remittance slip when paying at Branch. We also accept e-transfers, click here for more information https://biglakescounty.ca/resources/online-payments/

The Tax Instalment Payment Plan (TIPP) is a program that allows you to pay your property taxes monthly instead of one payment in June. Payments will be withdrawn from your bank account automatically through a pre-authorized withdrawal. TIPP makes budgeting easier and eliminates the risk of penalties; if your TIPP is in good standing, new penalties will not be applied.

Municipalities are not required to provide property tax receipts unless requested by the taxpayer. If you would like a receipt for taxes, please call or email our office.

Notice of Preparation of 2023 Assessment Role

NOTICE is hereby given that the Assessment Roll of Big Lakes County made under the provisions of the Municipal Government Act has been prepared for the year 2023, and is open to inspection in the County Office, in High Prairie, Alberta from 8:15am to 4:00pm, during business hours.

Any person who desires to object to the entry of their name or that of any person upon the said roll(s) or the assessed value placed upon any property must, lodge their complaint(s) on approved form with Big Lakes County Standard complaint forms are available at the Big Lakes County Office or online on the Big Lakes County website. Complaint forms must be completed and accompanied with the fee, as listed below by no later than JULY 3, 2023, before 4:00 p.m.

Appeal Fees:

Single Family residential and farmland $50.00 per roll account

Multi-family residential (more than 4 units) $350.00 per roll account,

Non-residential (commercial/industrial) $350.00 per roll account,

Complaints with an incomplete complaint form, submitted after the filing deadline or without the required fee, are invalid.

Tax assessments notices were mailed out April 26, 2023. Any person that doesn’t receive an assessment notice but wishes to appeal their assessment must do so by July 3, 2023, before 4:00 p.m.

Clerk, Assessment Review Board

BIG LAKES COUNTY

Box 239

High Prairie, AB T0G 1E0

Alberta Land Titles Processing Delays & Impact on Taxation Notices

Alberta Land Titles is reporting a four-to-five-month delay in processing land title transfers. In cases where a property has recently been sold, this may result in new owners not receiving their combined Assessment and Tax Notice that will be mailed out in May of 2023. If you have recently bought land, please make sure that your lawyer sends a copy of the seller’s information to our tax department so we can make sure that you receive your notice in time. NOTE: The deadline for payment of taxes remains last business day in June (June 30, 2023).

Tax Installment Payment Plan (TIPP)

TIPP allows you to pay your property taxes on a monthly basis instead of one payment in June. Payments will be withdrawn from your bank account automatically through a pre-authorized withdrawal. TIPP makes budgeting easier on your pocketbook and eliminates the risk of penalties; if your TIPP is in good standing, new penalties will not be applied. Call our office you if have any questions.

Frequently Asked Questions

Why are taxes important?

Municipalities raise funds for public services in various ways – including grant funding and user fees. However, taxes have long been a mainstay of municipal revenues and will continue to play an important role. These revenues are needed to sustain operations, infrastructure, and programs.

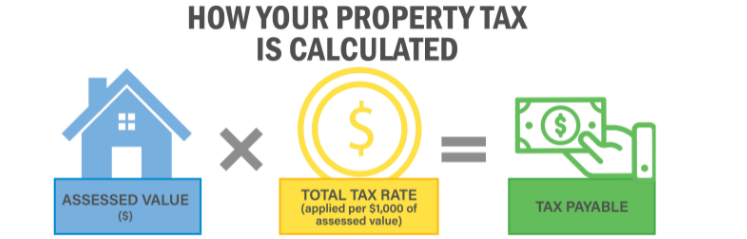

The primary means for municipalities to raise revenues is through property taxes. Property taxation is the process of applying a tax/mill rate to an assessed value of property to generate revenue. Rates differ among municipalities in light of various factors such as levels of services provided, the ratio of residential to commercial development, and council priorities.

What is a Mill/Tax Rate?

Each year during the budgetary process, council approves the amount of expense required to operate the municipality. From this amount they subtract revenues. The remainder represents the amount of money needed to be raised by property taxes.

The amount of money needed is divided by the total value off all the assessed property in the municipality and multiplied by 1,000 to decide the tax rate known as the “mill rate.”

‘Tax Rate’ and ‘Mill Rate’ are often used interchangeably. The tax rate is the number that is multiplied by each property’s assessed value to determine property taxes – usually expressed in four to six decimal places, ex. 0.008437.

How are taxes calculated?

This tool is used to estimate your property taxes for 2022.

Note that:

- The Tax Rate Bylaw is passed annually by Council in May of each year.

- The tax rate is based on the annual operating budget and tax support requirements.

- Property taxes are calculated using the assessment of your property:

The Assessed Value is determined by our independent assessment company, Compass Assessments. The Total Tax Rate is set by Big Lakes County, the Province, and other tax authorities. The Tax Payable is to be paid by the taxpayer.

Penalties apply to any unpaid portion of property taxes. Penalties will be levied on unpaid accounts on the following dates:

- July 1, 2022 – 7.5% penalty

- February1, 2022 – 14.5% penalty

How can I appeal my assessment?

Property owners cannot appeal tax rates, but they can appeal the assessed value of their property. For more information on filing assessment complaints, please visit the Alberta Municipal Affairs website.

How can I view my assessment?

Ratepayers can now view their basic assessment information on their property (“Ratepayer Summary”). Click here for more details.

2023 Mill/Tax Rate

Big Lakes County’s 2023 municipal tax rates are included in the table below – note that these rates exclude school and seniors’ requisitions where applicable. For more information, please see the County’s Mill Rate Bylaw.

| Property Type | Tax Rate |

| Residential | 4.940% |

| Farmland | 4.940% |

| Non-residential | 16.152% |

| Machinery & Equipment | 16.152% |

| School – Residential | 2.5034% |

| School – Non-Residential | 3.4892% |

| Seniors | 0.27492% |

Why do I have to change my address with land titles?

It is very important that Land Titles has your correct mailing address. If they do not have a correct address they cannot notify you of any changes to your certificate of title, such as liens, caveats, and tax notifications.

Alberta Land Titles Processing Delays & Impact on Taxation Notices.

Alberta Land Titles is reporting a five to six-month delay in processing land title transfers. In cases where a property has recently been sold, this may result in new owners not receiving their combined Assessment and Tax Notice. If you have sold a property or bought one in Big Lakes County, please get your lawyer to send us an update or please call our office asap at 780-523-5955 and speak to our Tax Clerk. When Speaking to our Tax Clerk, you will be asked to provide additional information to verify your ownership of your property if the title transfer has not been completed by Alberta Land Titles.

What if I don't receive my tax notice?

Failure to receive your Tax Notice is not sufficient reason for not paying your property taxes on time. Penalties will incur as per tax rate penalty bylaw.

Request a Tax Certificate

A Tax Certificate is a legal document from Big Lakes County indicating the financial status of taxes for a particular property. The certificate indicates whether taxes and utilities for a specific property are paid, or in arrears.

Tax Certificates may be required by law firms or financial institutions when a property is being sold, refinanced or as a verification of paid taxes.

Tax Certificates cost $35 each and may be requested by filling out the following form:

Alberta Land Titles Processing Delays & Impact on Taxation Notices

Alberta Land Titles is reporting a delay in processing land title transfers. In cases where a property has recently been sold, this may result in new owners not receiving their combined Assessment and Tax Notice. Big Lakes County would appreciate the change of ownership, so we can amend our records.